Introduction: Personal financial wellness is a milestone in graduate medical education. Prior surveys addressing financial wellness have not included family medicine (FM) residents and to date, no literature has explored the relationship between perceived financial well-being and personal finance curriculum in residency. Our study aimed to measure the financial well-being of residents and its association with the delivery of financial curricula in residency and other demographics.

Methods: Our survey was included in the Council of Academic Family Medicine Educational Research Alliance (CERA) omnibus survey sent to 5,000 FM residents. We use the Consumer Financial Protection Bureau (CFPB) financial well-being guide and scale to measure financial well-being and categorize into low, medium, and high ranges.

Results: Two hundred sixty-six residents (response rate of 5.32%) responded with a mean financial well-being score of 55.7 (SD 12.1), in the medium score range. Financial well-being was positively associated with any form of personal financial curricula in residency, year in residency, income and citizenship. Most residents 204 (79.1%) agreed/strongly agreed that personal financial curricula are important to their education, and 53 (20.7%) never received personal financial curricula.

Conclusions: Personal financial well-being scores of family medicine residents are considered medium per the CFPB ranges we assigned. We find a positive and significant association with the presence of personal financial curricula in residency. Future studies should evaluate the effectiveness of different formats of personal finance curriculum in residency on financial well-being.

The Accreditation Council for Graduate Medical Education has emphasized general well-being as a milestone in graduate medical education.1 This construct includes personal financial wellness, defined as “a comprehensive, multidimensional concept incorporating financial satisfaction, objective status of financial situation, financial attitudes, and behavior.’’2

Medical careers often begin with debt3 and residency stipends do not balance loan repayments. Higher absolute debt predicts perceived depression, stress, and worse general health.4 Furthermore, family Medicine (FM) ranks among the lowest-compensated specialties5 with average annual compensation averaging $236,000.6

Survey studies in orthopedics, internal medicine, medicine-pediatrics7 and surgery8 found residents had low financial literacy and financial preparedness.9 While there have been studies about FM residents and debt,10,11 there are no studies evaluating financial well-being of FM residents.

Our study aimed to measure the financial well-being of residents and its association with the delivery of financial curricula in residency and other demographics.

Our survey questions were a part of a larger omnibus survey conducted by the Council of Academic Family Medicine Educational Research Alliance (CERA), methodology of which has been described previously.12

After American Academy of Family Physicians (AAFP) institutional review board approval, 5,000 resident members of AAFP were electronically surveyed between April and May 2021. The response rate for the survey was 5.32% (266/5,000).

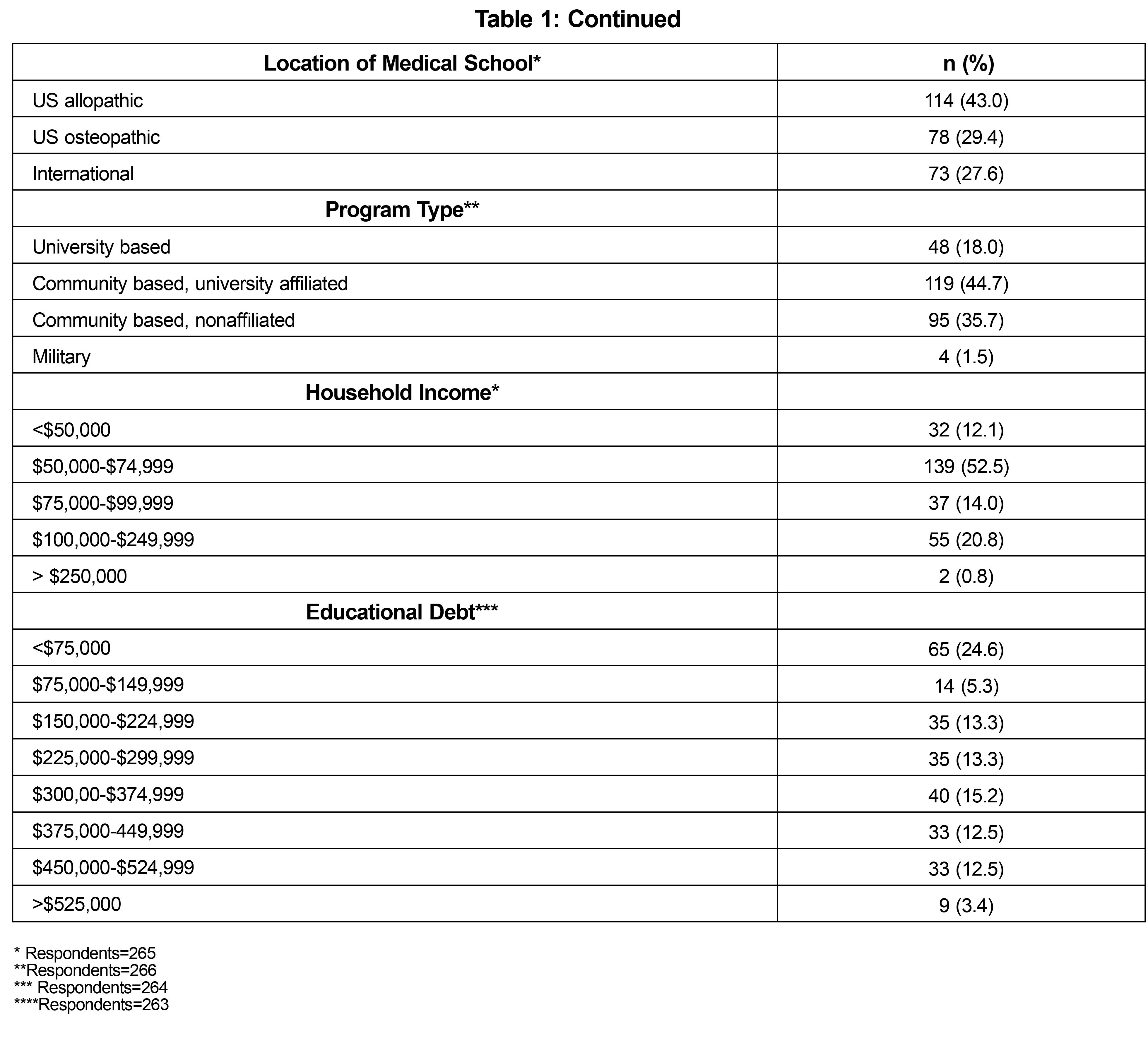

The Consumer Financial Protection Bureau (CFPB) financial well-being scale was included in the survey.13,14 The CFPB financial well-being scale employs the Item Response Theory (IRT) analysis, which is a more precise statistical measure than a simple summary score and returns a variable intermittent range from 19 to 82 with only 21 unique possible scores. Based on the frequency distribution of our data and financial literacy research, we determine three financial well-being classifications: low (19-39), medium (40-59), and high (60-82).

We conducted descriptive statistics (frequency and percentage, mean and standard deviation). We tested associations using χ2 tests and one-way analyses of variance to study the association between the financial well-being and the various demographics. We used Stata software, version 16.1 for all statistical analyses.16

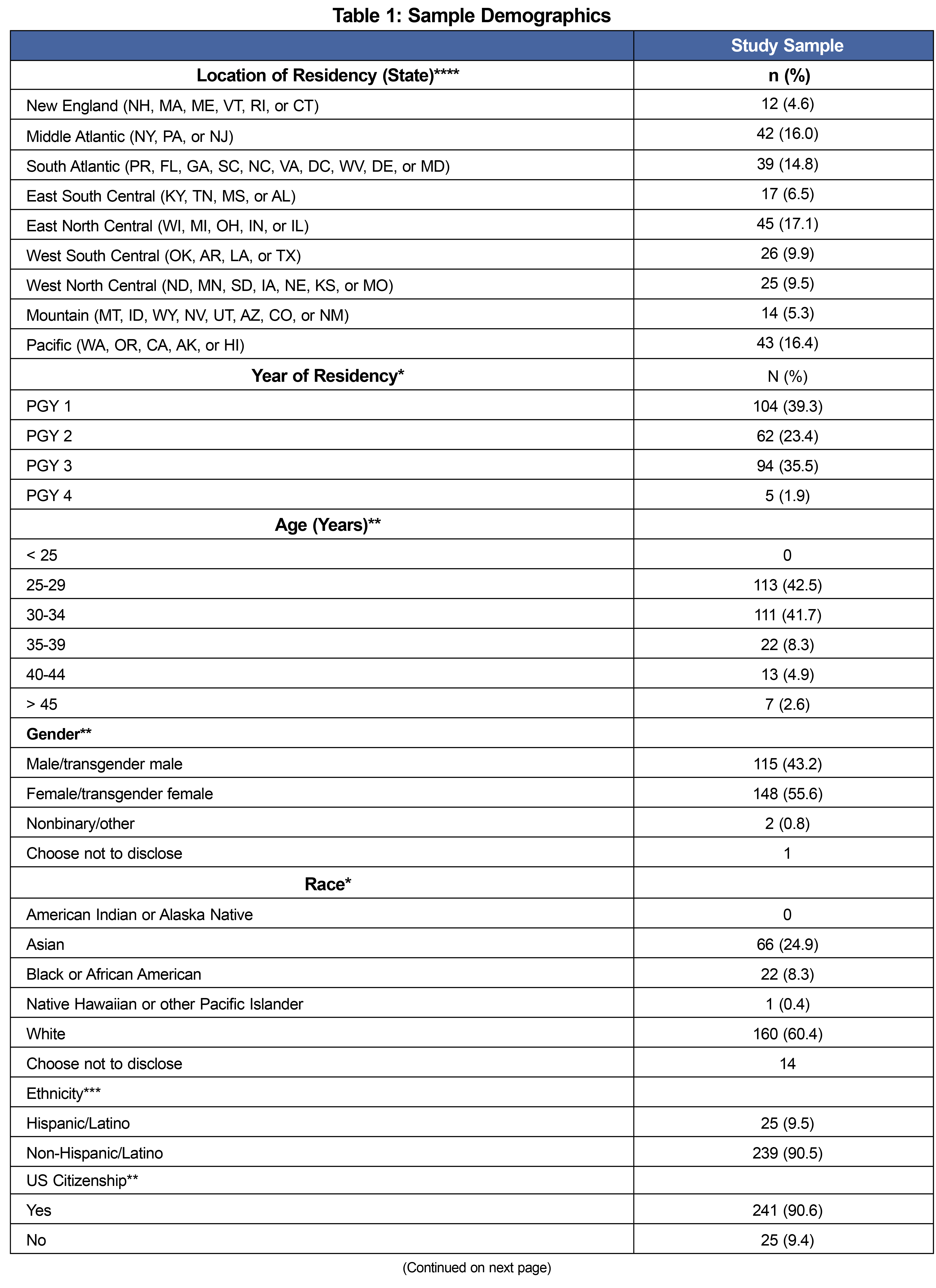

Respondents were 56% (n=148) women, 60% majority White (n=160) and 28% (n=73) were international medical graduates (IMGs). Table 1 provides descriptive statistics as well as demographics of respondents. The resident AAFP membership location is comparable and is the only equivalent data shared with us from the AAFP.

Mean financial well-being score of the residents is 55.7±12.1. According to our scale, a range of 40-59 is considered medium financial well-being with 55.7 being near the higher end. The distribution of the residents’ financial well-being across the various ranges is shown in Table 2. Compared to a national sample of adults in the United States aged 18 years and above, the financial well-being of our resident respondents lies between the 50th and 75th percentiles across all age groups and income status (see supplement 1).

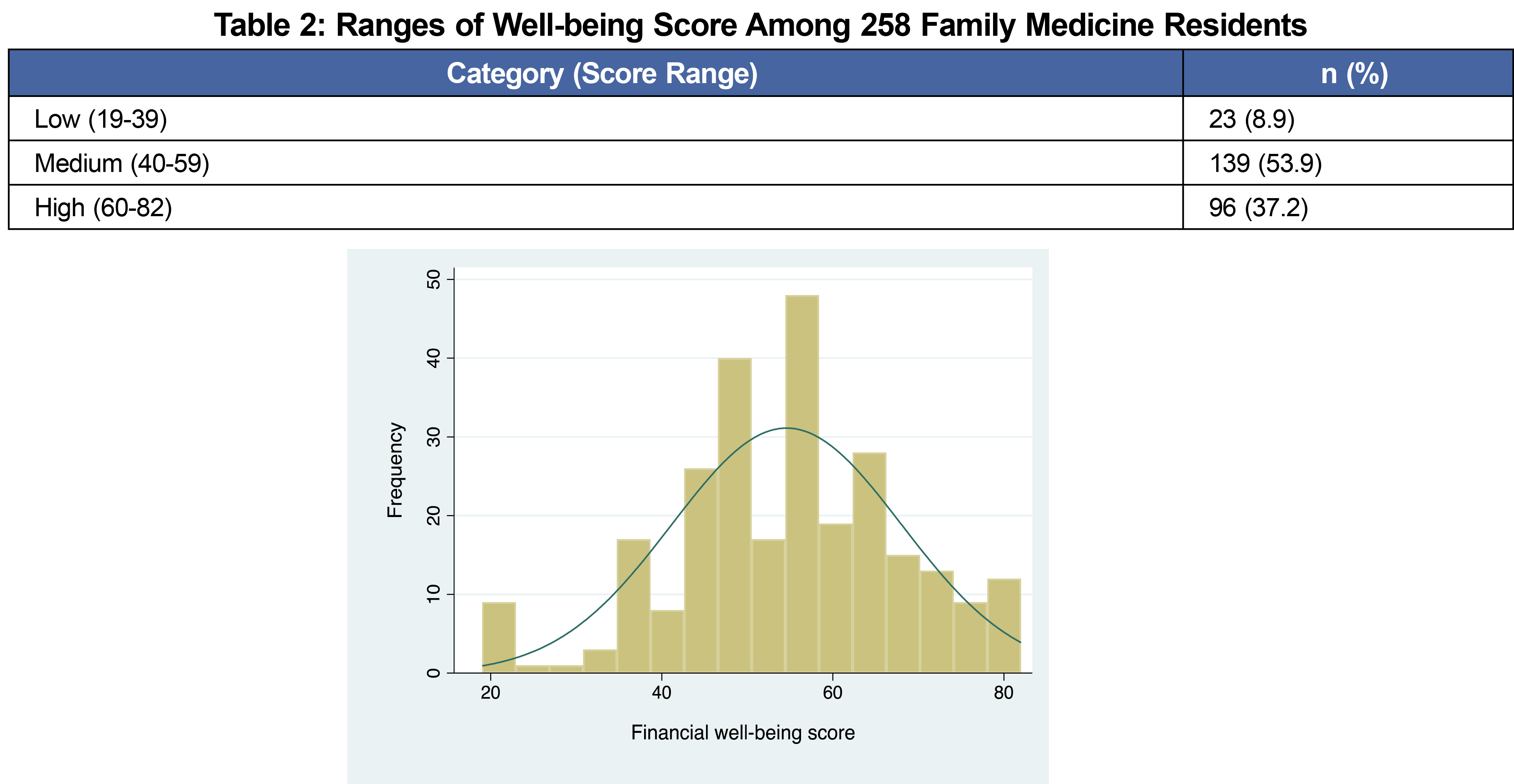

Financial well-being was positively associated with residency year (P<.05), the PGY-2 and PGY-3 residents had higher financial well-being scores than PGY1 residents (Table 3). Financial well-being was also positively associated with income (P<.01) and citizenship (P<.05); US citizens exhibit higher financial well-being scores compared to noncitizens. Educational debt is negatively associated with financial well-being (P<.001). Higher financial well-being is positively associated with the presence of any financial literacy curricula even if it was only offered once during the residency. Financial well-being is also higher among those who are interested in retirement planning and lower for those interested in curricula on debts and taxes.

The frequency of personal finance content delivery in our sample is as follows: “never” 20.7% (n=53), “once in the residency” 22.3% (n=57), between “once in the residency” and “once per year” 39.1% (n=100), and “1 to 4 times per year” 18% (n=46). Most respondents (79.1%; n=204) agreed/strongly agreed that financial curriculum is relevant to their education while 34 respondents (13.2%) neither agreed or disagreed, and 20 respondents (7.7%) disagreed. We did not find a correlation between FM residents’ attitudes about relevance of financial curriculum and receiving finance content in the curriculum.

When asked about the preferred format to deliver personal finance curriculum, 39% (n=101) of residents reported “access to personal finance advisor,” 31% (n=80) “workshop,” 16.3% (n=42) “lecture/presentation,” 8.9% (n=23) “web-based modules,” and 4.7% (n=12) “written or online resources.” Many of the residents (66.3%, n=171) reported that this information should be delivered throughout the residency, while 18.2% (n=47) reported optimal delivery during PGY2 and later and 15.5% (n=40) prefer delivery in PGY1.

This is the first study to attempt a measurement of resident personal financial well-being with the CFPB scale. Higher financial well-being was positively correlated with any personal finance curricula in residency. Although our study of FM residents reveals mean CFPB scores in the upper medium range when compared to the US adult population, we find almost one in five FM residents reported not receiving personal finance curriculum during their training, despite many of them indicating this curriculum is relevant. To address this, residency programs should focus curriculum efforts on debt and financial well-being of FM residents. Systematic reviews illustrate that early and sustained interventions for wellness are key.17 Just-in-time intervention of financial education can be beneficial to financial well-being.18 Residents in our study indicated time with a personal financial advisor and workshops would be preferred for delivery content.

Limitations to our work include a low response rate, which is often seen in electronic surveys19 and especially notable given this CERA survey was not a part of the regular annual surveys. A low response rate introduces potential bias related to small sample size. Reassuringly, despite these limitations, the CFPB can be a feasible and useful tool for understanding resident financial well-being.

In conclusion, a national survey of FM residents revealed medium-high personal financial well-being, with higher well-being positively associated with any financial curriculum in residency. Most FM residents found personal financial curriculum relevant to their education and would like curriculum throughout residency. Residency programs can use this information and the CFPB tool to assess and support financial well-being curriculum development.

Acknowledgments

Presentations: Some portion of the content of this manuscript was presented as a poster at the first author’s institutional Research Day in April 2022.

References

- Accreditation Council for Graduate Medical Education. ACGME Common Program Requirement. Published 2020. Accessed December 19, 2022. https://www.acgme.org/Portals/0/PFAssets/ProgramRequirements/CPRResidency2020.pdf

- Joo S. Personal Financial Wellness. In: Xiao J, ed. Handbook of Consumer Finance Research.Springer New York; 21-33, doi:10.1007/978-0-387-75734-6_2.

- Jolly P. Medical school tuition and young physicians’ indebtedness. Health Aff (Millwood). 2005;24(2):527-535. doi:10.1377/hlthaff.24.2.527

- Sweet E, Nandi A, Adam EK, McDade TW. The high price of debt: household financial debt and its impact on mental and physical health. Soc Sci Med. 2013;91:94-100. doi:10.1016/j.socscimed.2013.05.009

- Martin K. Medscape Family Physician Compensation Report 2021. Published 2021. Accessed May 28, 2021. https://www.medscape.com/slideshow/2021-compensation-family-physician-6013848#2

- Kane L. Medscape Physician Wealth & Debt Report 2021. Published June 11, 2021. Accessed December 19, 2022. https://www.medscape.com/slideshow/2021-compensation-wealth-debt-6013910

- Wong R, Ng P, Bonino J, Gonzaga AM, Mieczkowski AE. Financial Attitudes and Behaviors of Internal Medicine and Internal Medicine-Pediatrics Residents. J Grad Med Educ. 2018;10(6):639-645. doi:10.4300/JGME-D-18-00015.1

- Tevis SE, Rogers AP, Carchman EH, Foley EF, Harms BA. Clinically Competent and Fiscally at Risk: Impact of Debt and Financial Parameters on the Surgical Resident. J Am Coll Surg. 2018;227(2):163-171.e7. doi:10.1016/j.jamcollsurg.2018.05.002

- Ahmad FA, White AJ, Hiller KM, Amini R, Jeffe DB. An assessment of residents’ and fellows’ personal finance literacy: an unmet medical education need. Int J Med Educ. 2017;8:192-204. doi:10.5116/ijme.5918.ad11

- Phillips JP, Peterson LE, Fang B, Kovar-Gough I, Phillips RL Jr. Debt and the Emerging Physician Workforce: The Relationship Between Educational Debt and Family Medicine Residents’ Practice and Fellowship Intentions. Acad Med. 2019;94(2):267-273. doi:10.1097/ACM.0000000000002468

- Phillips JP, Peterson LE, Kovar-Gough I, O’Neill TR, Peabody MR, Phillips RL Jr. Family Medicine Residents’ Debt and Certification Examination Performance. PRiMER Peer-Rev Rep Med Educ Res. 2019;3:7. doi:10.22454/PRiMER.2019.568241

- Seehusen DA, Mainous AG III, Chessman AW. Creating a centralized infrastructure to facilitate medical education research. Ann Fam Med. 2018;16(3):257-260. doi:10.1370/afm.2228

- Consumer Financial Protection Bureau. Financial well-being in America. Published 2017. Accessed January 31, 2021. www.consumerfinance.gov/

- Consumer Financial Protection Bureau (CFPB). Measure and score financial well-being. Accessed August 12, 2021. https://www.consumerfinance.gov/consumer-tools/educator-tools/financial-well-being-resources/measure-and-score/

- Phillips JP, Morgan ZJ, Bazemore AW, Peterson LE. Debt of Family Medicine Residents Continues to Grow. J Am Board Fam Med. 2021;34(3):663-664. doi:10.3122/jabfm.2021.03.200567

- Stata Software. 2019. https://www.stata.com/

- Eskander J, Rajaguru PP, Greenberg PB. Evaluating Wellness Interventions for Resident Physicians: A Systematic Review. J Grad Med Educ. 2021;13(1):58-69. doi:10.4300/JGME-D-20-00359.1

- Fernandes D, Lynch JG Jr, Netemeyer RG. Financial Literacy, Financial Education, and Downstream Financial Behaviors. Manage Sci. 2014;60(8):1861-1883. doi:10.1287/mnsc.2013.1849

- Shih T-H, Fan X. Comparing Response Rates in E-Mail and Paper Surveys: A Meta-Analysis. Educ Res Rev. 2009;4(1):26-40. doi:10.1016/j.edurev.2008.01.003